Freight Market Roundup | Week 3 (January 18th - 24th)

Ocean Highlights

Most carriers will keep their rates til January 31st.

HMM $400 GRI effective on 1/15 on all lanes, except Taiwan ports. There is an EIT Equipment Intermodal Charge - $350 per box - effective February 1st.

GRI for February 1st and 15th at $960 per TEU each.

Moving containers to and from Hong Kong and Shenzhen has been very difficult due to suspended feeder services in the Pearl River Delta. The suspension has left carriers struggling to meet import and export demand from South China’s busiest ports ahead of the Chinese New Year.

Covid-19 continues to disrupt supply chains with quarantine requirements for ship crews onboard once someone tests positive.

Premium rates to get empty containers and space in vessels could range from $1500 to $1750 per unit - just for the premium charge.

Vietnam’s shortage is now for all container sizes.

Space from China its full and tight until mid February at least.

Rates and congestions aren’t expected to get better any time soon - we should have to deal with these issues throughout Q1.

Current space status in China from week 3 - 5:

Shanghai

All carriers are facing container shortages.

Space has been overbooked until mid February.

Too many blank sailings caused space for PNW gateway to be an issue now.

Ideally, send your bookings at least 4 weeks in advance to make sure you get space.

Ningbo

Equipment and container shortage.

Space has been booked until the Chinese New Year.

Dalian

Space has been booked until the Chinese New Year, especially for PNW due to many blank sailings. Some carriers have stopped accepting new bookings.

Equipment and container shortage.

Qingdao

Space has been booked until the Chinese New Year.

Equipment situation is getting worse. Expect shortage on all container sizes. Some carriers are starting to limit the gross weight.

Nanjing

Equipment and container shortage.

Space has been booked until the beginning of February.

Tianjin

Factories closed in HEBEI province due to the increase in Covid-19 cases, therefore cargo can’t be delivered.

Space to PSW/PNW/USEC/GULF is fully booked until week 6.

Equipment and container shortage.

It’s highly recommended to book at least 4 weeks in advance.

Nansha

Shortage of 40GP&HQ.

Space has been booked until the Chinese New Year.

Fujian

Space has been booked until the end of January.

February’s vessel schedule is still pending.

Xiamen

Space has been fully booked until early February. Paying premium rate will not guarantee space.

Shortage of containers.

Taiwan

CMA/YML/ZIM are having container shortages.

Space has been booked until the Chinese New Year.

Air Highlights

Rates to the West Coast are around $5.91/kg - valid until January 23rd.

Air cargo demand between Europe and the UK is starting to pick up as some truckers have put the breaks on services and additional paperwork is creating hold ups. Read more.

Virgin Atlantic is planning to ramp up its all-cargo operations as demand continues to increase. The airline said that it plans to increase its cargo-only operations by 60% in January, adding an extra 12 rotations per week and bringing its weekly total to 33. Read more.

Trucking & Rail

After a sharp rebound in freight demand in the second half of 2020, US less-than-truckload (LTL) operators are operating more profitably and seeking higher rates for 2021, while shippers are prioritizing capacity and on-time performance.

Rising industrial freight volumes will keep pressure on truckload capacity and pricing in 2021, even if demand for goods peaks, according to FTR Transport Intelligence analysts.

A chassis shortage has caused some containers to idle at BNSF’s ramp in St. Paul, Minnesota, an offshoot of the congestion in Chicago, but not as disruptive given the relative small rail volume in the Twin Cities.

Rising industrial freight volumes will keep pressure on truckload capacity and pricing in 2021, even if demand for goods peaks, according to FTR Transport Intelligence analysts.

The China-Europe rail network is creaking under the same space and equipment shortages, and soaring rate levels, that are disrupting air and ocean markets.

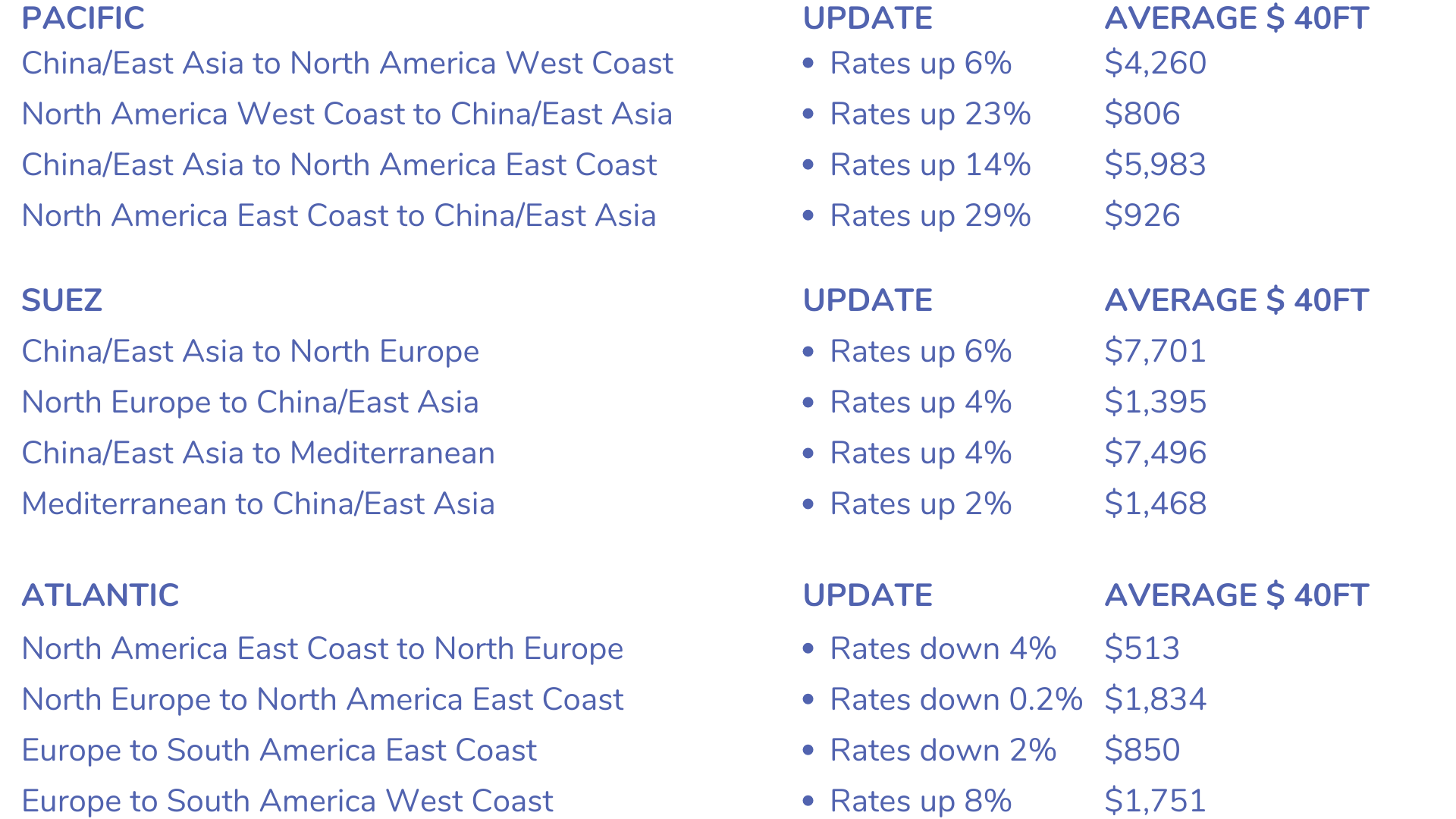

Rate Trends